2024.10.09 ZEBRAS

Explanation of the ZebraInvestment Scheme “LIFE type1” – An Investment Scheme Independent of IPO Plans and Designed to Think about Growth Together with Investors,

At Zebras and Company (hereafter, Z&C), we provide management support and investments to foster changes in companies to transform their management and financial practices to reflect practices that are carried out in zebra companies.

Zebra companies do not aim solely for business growth but strive for a balance between solving issues and achieving growth. This inherent complexity means that traditional investment schemes often do not readily apply to them.

In exploring investment approaches that align with our values, we developed a new investment scheme named “LIFE type1 (Long-term Investment Scheme for Future Equity Prototype 1)” for our first investment in “Hitobito.” In this article, we would like to introduce this investment scheme.

We hope this will serve as a new option for managers and investors who have experienced difficulty with traditional investment schemes.

“LIFE type1”: An Investment Scheme with Diverse Options

For entrepreneurs of startups, defining the form of future exits and the path of growth is not easy. However, when trying to gather funds to grow the business without a track record, it is challenging to raise sufficient funds through loans or grants. On the other hand, considering VC-type investments might force the entrepreneur to aim for an IPO or business sale. This path of a short term exit might not align with their true intentions for the business.

We often receive consultations such as, “Initially, we received investment aiming for an IPO, but t considering our direction and business model in hindsight, a quick IPO might not have been the best choice.

Considering such challenges, Z&C developed the “LIFE type1” investment scheme to explore more diverse fundraising methods. This scheme sets agreed-upon business growth targets and investment return levels at the time of investment consideration while keeping various options for exits and returns open depending on the actual business growth.

“LIFE type1” is designed to ensure that upon achieving the goals, shareholder returns through company stock buybacks can be executed with the consensus of non-managing shareholders, without impacting management. It also accommodates the evaluation of alternative capital strategies beyond just stock buybacks.

“LIFE type1” Features

Let us introduce three key features of LIFE.

The first is the flat relationship between company managers and investors. From the manager’s perspective, it allows for making long-term, fundamental management decisions without being bound by short-term returns. Thisalso considers personal life goals in the planning process. On the other hand, for investors, the scheme ensures shareholder returns when the invested companies grow, providing appropriate returns for the risks taken. “Mutual benefit and coexistence” is a key concept representing zebra companies, and this philosophy of prospering together with all stakeholders is well reflected in the LIFE scheme.

The second feature is flexibility. For newly founded businesses, there are constant changes in the company, making it difficult to predetermine a fixed future.. It is also common for management or business plans to deviate from its original intent due to being bound by investor expectations for short-term returns. LIFE ensures the flexibility to adapt and diverge into various outcomes upon meeting pre-agreed business goals, freeing businesses from the constraints of short-term timelines, which allows for desired medium- to long-term visions to be met.

The third feature emphasizes the trust and dialogue between business managers and investors. The less formal structure requires ongoing dialogue to foster mutual understanding and trust. A dialogue which must take place both during the investment scheme formulation before the investment and upon achieving post-investment business goals. This process will be detailed in the following chapter.

How to Proceed with Considering Zebra Investments

Next, we would like to introduce the process of actual investment consideration and preparation for receiving investments.

At Z&C, our investment consideration begins not with discussions about money but by articulating the “desired vision.” The method of fundraising changes depending on the vision of the world one aims for and the type of money one wants to gather.

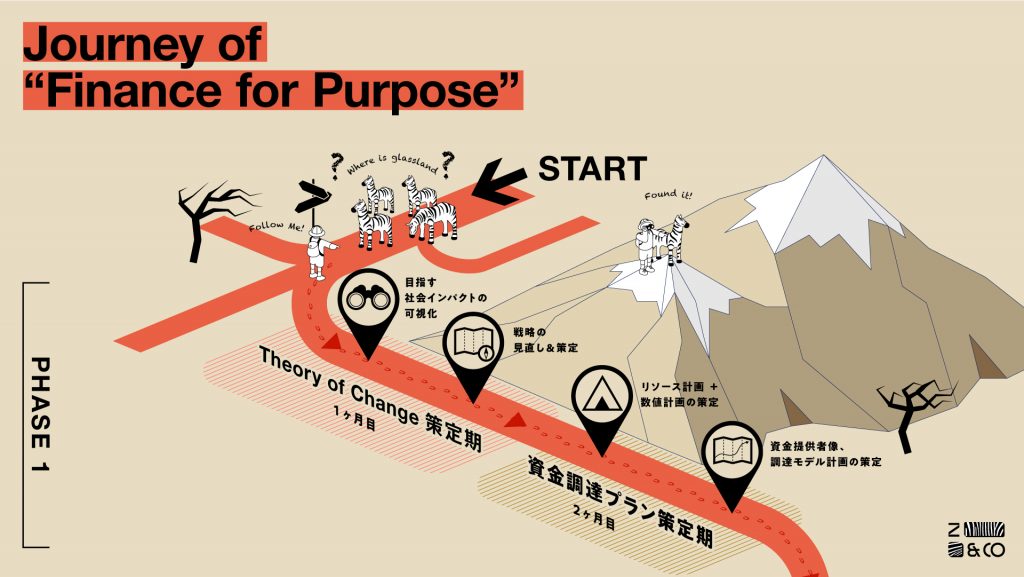

The first discussion revolves around the Theory Of Change (TOC). Instead of starting with traditional numerical goals of sales or business size, we begin by focusing on the social impact the company aims to achieve. This becomes the base in which we organize and redefine the business strategies presented before us. After establishing the TOC, we then proceeded with discussions on business strategies and fundraising plans.

(資金調達支援全体の流れについて、詳しくはこちらの記事(Finance for Purpose)にまとめてありますのでぜひご参照ください)

If the LIFE scheme seems appropriate in terms of flexibility and time perspective after workshopping the desired state, we proceed to flesh out its contents further.

As mentioned, LIFE is a scheme that retains future flexibility, but it does not mean nothing is decided. We set immediate business goals that are agreed upon by both managers and investors and discuss broad options available upon achieving those goals.

The creation of the scheme primarily emphasizes building a trusting relationship between managers and investors. With flexibility left in the term sheet, deciding on the future path requires mutual understanding through dialogue between both parties. Investors need to deeply understand the managers’ intentions without imposing their own opinions., While managers need to sincerely examine the feasibility of the business while understanding the returns investors expect. Let us find points of agreement through numerous discussions between both parties.

Moreover, as “LIFE” is named “type1 (prototype 1),” it is still in the prototype phase. We believe there is substantial potential for improvement, and we have made it public so that various people can use it. We hope to accumulate different patterns of LIFE in order to continue to improve this investment scheme.

Frequently Asked Questions

——What kinds of companies are compatible with LIFE type1?”

We believe companies that, like zebra companies, aim to create social impact and contribute to all stakeholders, as well as those not originally seeking the rapid growth and scale typical of VC expectations, are well-suited for LIFE type1. However, there may be other companies that would be a good fit depending on how it is adapted since LIFE is still a prototype scheme.

——What kinds of companies are not suited for the LIFE type1 scheme?

As a scheme that prioritizes flexibility, LIFE type 1 is not suitable for those with VC fundraising with a specific goal like IPOs. It is also not fitting for businesses where shareholder returns are inherently difficult (not profitable or growth-oriented enough to cover capital costs) or in a stage where agreeing on “certain business goals” is not feasible (still exploring social issues, conceptualizing possible solutions, etc.). For these cases, considering non-economically focused angel investments or donations for fundraising is recommended.

——What investors are compatible with LIFE type1?”

It is particularly well-suited for investors (individual investors, corporate businesses, local banks, etc.) who are aiming at specific business goals (creating social impact, synergy with their businesses, etc.). It may also be a good alternative to angel investments for corporate or institutional investors responsible for explaining the exit strategy to stakeholders.

Conversely, due to its inherent flexibility, LIFE is not recommended for those with fixed exit expectations or extremely short business evaluation periods, like some VC positions.

The investment case by JR East Japan Local Startup LLC in 2023 might also be informative, so please have a look if you are interested.

——How does it differ from angel investing?

Angel investing typically refers to individual investors directly investing in startups, primarily in their founding stages. However, what is expected from each investment varies significantly between individual investors (some invest with VC-like intentions, while others support entrepreneurs without emphasizing economic viability). It is difficult to generalize the differences between angel investing and LIFE. However,LIFE’s characteristics include not presuming an IPO while still having pre-agreed terms on certain business goals and a mechanism for economic returns upon business growth.

——Despite emphasizing flexibility, what are the essential points to secure initially?

Firstly, is the concept. It is crucial to confirm what the entrepreneur wants to achieve and their desired vision.This information is used as the basis to proceed with fundraising. The second is immediate business goals. While LIFE emphasizes flexibility, it does not mean nothing is determined. Set a pre-discussed timeline to reconsider (dialogue) the business direction with the entrepreneur and investor. Business goals do not necessarily have to be sales; they can be user numbers, social impact, or anything relevant to the business concept.

That was an introduction to the investment scheme LIFE.

Some may feel interested but might not know how to utilize it from this article alone. As mentioned, LIFE is still a prototype with complexity, and we acknowledge the need to simplify it. However, the understanding on how to use it will likely spread as more cases emerge.

If you are interested, we hope to explore better methods through dialogue, so please feel free to contact us.

https://www.zebrasand.co.jp/contact

PROFILE

ゼブラ編集部

「ゼブラ経営の体系化」を目指し、国内外、様々なセクターに関する情報を、一緒に考えやすい形に編集し、発信します。